Most of this information was taken from the book PIPEs: Private Investments in Public Equity. Some of the information I put into this article was found from other sources, but about 80% is taken directly from this book. I'm going to start by going over most of the key terms, regulations, laws, and definitions that are used in the book. Later I'll try to put some of this in context of how it effects traders.

I'll also reference other sources besides the book along the way.

What is a PIPE Deal?

PIPEs (private investments in public equity) allow public companies to quickly raise capital by selling shares directly to institutional investors at a negotiated price. This avoids the lengthy and expensive process of a secondary public offering.

In a PIPE deal, the company appoints an investment bank to help find accredited investors and negotiate terms. The investors commit capital in exchange for shares, or convertible securities, at a discount to the market price. This benefits both the company seeking funds and the investors seeking undervalued shares.

While PIPE deals close faster than public offerings, they are still regulated by the SEC. Companies must file registration statements for the new shares within a set number of days after closing. Investors also face blackout periods restricting when they can sell shares and the shares must be declared Effective by the SEC.

Basic Definitions & Terminology

PIPE

A PIPE is a privately negotiated investment in a public company.

Qualified Institutional Buyers

QIBs, or qualified institutional buyers, are key investors in larger PIPE transactions. QIBs are large institutional investors that meet certain SEC criteria, including having at least $100 million in investable assets.

Accredited Investors

An individual or institution deemed capable of understanding the financial risks of purchasing restricted securities. It's a standard meant to protect less sophisticated investors.

For individuals, accredited investors must have either:

- Annual income of $200,000 individually or $300,000 jointly with spouse for the last 2 years and expected this year

- Net worth over $1 million individually or jointly with spouse, excluding primary residence

Other Ways to Qualify

- Entities like banks, business development companies, 501(c)(3) organizations with over $5 million in assets

- Directors, executives, general partners of the issuing company

Underwriters

Underwriters serve as principals by purchasing securities from the issuer and reselling to the investors, which is not the standard structure of a PIPE deal. PIPEs involve direct private placements and negotiation of the purchase agreement between the issuer and investors without an underwriting agreement. Overall, underwriters are generally not involved in PIPE deals, which predominantly use Placement Agents rather than underwriters to find investors.

Placement Agents

Issuing companies select the investment bank that will serve as the company's Placement Agent. Placement agents play a leading advisory role in PIPE transactions by identifying and soliciting potential investors, conducting due diligence, structuring deal terms, facilitating negotiations between the issuer and investors, arranging investor meetings, and closing the deal. They serve as an intermediary between the issuer and investors during the transaction.

Some of the most common placement agents I've been seeing in recent PIPE deals have been HC. Wainwright, Roth Capital, Maxim Group, Aegis Capital, Oppenheimer & Co., and Cantor Fitzgerald.

Shelf Registration

A shelf registration allows a company to register securities with the SEC but delay issuing them for up to 3 years, providing flexibility to access capital markets quickly when needed without SEC review delays. Shelf registrations are done on Form S-3 or F-3. The Form S-3 includes a base prospectus and other information about the securities being offered.

When ready to issue securities, the company does a "shelf takedown" offering and takes the securities off the shelf. Shelf registrations allow companies to control the timing and amount of securities issued based on market conditions and company needs rather than being tied to a timeframe. The key advantage is the ability to access capital when markets are favorable, without registration delays.

Base Prospectus & Prospectus Supplement

A base prospectus contains general information about the issuer and the securities being offered under a shelf registration statement. It is filed as part of the initial shelf registration and allows certain information to be omitted that will later be provided in a prospectus supplement. The base prospectus includes things like a general description of the issuer and its business, the types of securities that may be offered, risk factors, and financial statements.

When the issuer wants to do a takedown off the shelf, it files a prospectus supplement containing the omitted details for that specific offering such as the amount of securities, pricing, and use of proceeds. The base prospectus and prospectus supplement together form the complete prospectus for each shelf offering. This avoids delays from new registrations. The base contains basic information constant across takedowns, while the supplement provides the variable details.

PIPEs: Private Investments in Public Equity

Master the sophisticated world of private placements in public companies. Learn how institutional investors access discounted equity positions, understand regulatory frameworks, and navigate the complex structures that make PIPEs a powerful tool for both capital raising and alternative investing.

View on AmazonRegistered Direct Transaction

An offering that is also considered to be a PIPE and is issued to Accredited investors. However, in contrast to Rule 144 PIPEs (non-rule 144A), the securities issued have already been Registered and declared Effective by the SEC.

Follow-on Offering

A follow-on offering is when a company that is already public offers additional shares of stock for sale. This can include both newly issued shares from the company itself (primary offering) and existing shares sold by current shareholders (secondary offering).

At-the-Market (ATM)

An offering made by incrementally selling common shares into open market at the bid price. Shares are sold over a period of time rather than in a single discrete offering.

Equity Lines

A financing agreement where a company gets a commitment from an investor to purchase shares at a future date, often at a pre-determined discount to the market price. The company can then "draw down" on the equity line by selling common stock to the investor in tranches over time once a resale registration statement is effective.

Convertible Bonds

Convertible bonds are a type of corporate bond that can be converted into a set number of the issuer's common shares. Companies issue convertible bonds to raise capital at lower interest rates than regular bonds since investors accept lower yields due to the conversion feature. Investors get fixed income from regular coupon payments, and can convert the bonds to equity if the share price rises above the conversion price, set at issuance.

Warrants

Warrants are securities that give investors the right to purchase additional shares of the issuer's stock at a predetermined price. Warrants are issued in almost every PIPE deal, they are often included as "sweeteners" in PIPE deals to provide additional upside potential for PIPE investors. The warrant coverage ratio in a PIPE deal determines how many warrants investors receive relative to the number of shares purchased. A 1:1 ratio is common. Upon exercise, warrants dilute existing shareholders since new shares are issued.

Traditional PIPE

- Fixed Price: Investors purchase common stock or preferred stock at a fixed, pre-determined price.

- Registration: Shares are registered on a resale registration statement that is filed and declared effective shortly after the PIPE closes. Investors are named as "selling shareholders" on the registration statement and can freely resell shares after effectiveness

- Price Risk: Investors bear the price risk from pricing to closing - the issuer cannot adjust the price.

- Governance Rights: Typically does not involve governance rights or control for investors.

- Timeline: Faster timeline - can close in 3-10 days after definitive agreements.

- Liquidity: Securities are more liquid after closing since they are freely tradeable.

Structured PIPE

- Variable Price: Investors purchase convertible securities with variable or resettable prices.

- Registration: Shares are initially issued as restricted securities. A resale registration statement is filed at a later date, often 6-12 months after closing.

- Price Adjustment: Prices can be adjusted downward to protect investors if market conditions change.

- Control Rights: Investors often get governance rights like board seats.

- Timeline: Generally takes longer than traditional PIPE.

- Liquidity: Issued securities have resale restrictions so less liquidity for investors.

SEC Forms

Form S-1

Form S-1 is the registration statement required by the SEC when a company first conducts a public offering of securities like an IPO. It provides comprehensive disclosures about the company's business, financials, management, and risks so investors can evaluate the offering. In a PIPE deal, the company sells stock to private investors and commits to filing a Form S-1 resale registration statement (Form S-3 is another option) allowing investors to resell their shares to the public. The Form S-1 discloses details of the PIPE transaction, use of proceeds, and risks of owning the stock.

Form S-3

Form S-3 is a short-form registration statement that allows faster and easier SEC review compared to the lengthy S-1 form, if the issuer meets eligibility requirements like having a public float over $75 million and being current on SEC filings. For PIPE deals, the company commits to registering the PIPE shares on Form S-3 if eligible. Form S-3 registration allows PIPE investors to freely resell shares once registered, while ineligibility forces the company to use the slower S-1 process, which can deter investors. Key PIPE disclosures in an S-3 include details of the transaction, dilution impact, and risks to public shareholders.

Form 8-K

Form 8-K is a report companies must file with the SEC to disclose major events like a PIPE deal, which is a material definitive agreement. The 8-K provides details on the PIPE transaction including the date, investors, number of shares sold, purchase price, fees paid, and basic terms. It allows the company to comply with disclosure requirements and provide transparency to shareholders. Key disclosures include registration rights requiring a resale registration statement within a certain timeframe after closing the PIPE, as well as dilution and other risks of the deal.

Resale Registration Statement

After a PIPE deal closes, the issuer files a registration statement to register the resale of the PIPE shares by the investors. This is known as a resale registration statement. Usually filed on Form S-3 or Form S-1 within 30-60 days after PIPE closing as required under registration rights provisions. Names the PIPE investors as "selling shareholders" rather than issuers or underwriters. The resale registration statement contains information about the company, management, shareholders, details of the PIPE deal, dilution impact, risks etc.

In a PIPE, a resale registration statement is used instead of a Primary Registration Statement, which is for the issuance of new securities directly to the issuer.

SEC Regulations & Rules

Securities Act of 1933

The Securities Act of 1933 was passed after the 1929 stock market crash to regulate securities transactions and sales. It requires companies offering securities to the public to register the securities and provide extensive disclosures about the securities offered. The Act prohibits deceit, misrepresentations, and fraud in the sale of securities and allows investors to sue for false or misleading information. It established greater federal regulation of securities sales which were previously regulated by states. The Act laid the framework for securities regulation that was built on by subsequent laws.

Securities Exchange Act of 1934

The Securities Exchange Act of 1934 was passed after the 1929 stock market crash to further regulate securities trading. It established the Securities and Exchange Commission (SEC) to enforce federal securities laws, and requires periodic financial reporting by public companies to ensure transparency. The Act gives the SEC broad authority to regulate and oversee all aspects of the securities industry. It prohibits manipulative practices like insider trading and false financial disclosures. Overall, the Securities Exchange Act of 1934 strengthened regulation of secondary market securities trading and continues to serve as a foundation of securities market oversight today.

Section 5

Section 5 of the Securities Act of 1933 sets forth registration and prospectus delivery requirements. Section 5 prohibits the sale of securities unless a registration statement is in effect or there is an exemption. Its main purpose is to require adequate disclosures to investors and prevent deceitful activities related to offerings. A number of exemptions from Section 5 are available.

Section 4(2)

Section 4(2) of the Securities Act provides an exemption from registration requirements of Section 5 for private placements. The rationale for the exemption is that the investors in private investments are more suited to protect themselves. Many PIPE deals rely on Section 4(a)(2) to sell securities to accredited investors in a private placement.

Regulation D

Regulation D (eight rules, 501-508) provides more clarity on SEC registration exemptions offered by Section 4(2). To qualify for Regulation D exemptions, a PIPE must meet requirements like not using general solicitation or advertising and selling only to accredited investors. PIPE shares sold under Regulation D are "restricted securities" until a registration statement is filed and becomes effective.

Regulation Fair Disclosure (FD)

Reg FD was designed to level the playing field between institutional and individual investors. Under Reg FD, public companies cannot reveal material nonpublic information to selected investors without disclosing it to the public at the same time. Investors must also agree to keep secret the potential PIPE offering until the transaction has been announced publicly. Therefor the investor must also not trade in the issuer's securities until the announcement. Issuers will file a Current Report on Form 8-K and issue a press release. Precautions need to be taken to avoid inadvertent disclosures or leaks of transaction details or projections that could violate Regulation FD.

Rule 144A

Provides a safe harbor from Section 5 registration requirements. Requires that the unregistered securities be sold only to Qualified Institutional Buyers (QIBs). These sales are not considered PIPEs and the deals are typically larger in size than PIPEs.

Non-Rule 144A (or Rule 144)

These are PIPE transactions that rely on Section 4(2) and Regulation D for the initial private placement, and can be made to Accredited investors more broadly. Non-Rule 144A (Rule 144) PIPEs are what we think about when we talk about PIPE deals.

20% Rule

The 20% rule refers to exchange listing requirements that generally prohibit a listed company from issuing more than 20% of its outstanding shares without shareholder approval. (1)

Baby Shelf Rule

The baby shelf rule applies to companies with a public float value under $75 million that file a Form S-3 shelf registration statement. It limits the amount these smaller companies can sell off the shelf to one-third of their public float in any 12-month period. Public float is measured at S-3 filing and in annual 10-Ks to determine applicability. If public float exceeds $75M, the company is no longer subject to baby shelf limits until the next measurement date. Overall, the rule allows Form S-3 access for smaller companies but with caps on shelf issuances to protect against overuse and excessive dilution. (1)

- Smaller companies can avoid Baby Shelf rule by registering a form S-1

Downside Protections for Investors

Downside Protection comes in the form of contractual provisions that allow the investor to protect the original value of the investment in the event of a decline in the company's common stock price over time. Typically implemented through:

- Principal Protections

- Price Protections

- Anti-Dilution Protections

Principal Protections

Contractual provisions that aim to protect the original investment amount for PIPE investors.

- Mandatory Repayment of Principal Rights - Some PIPE deals give investors the contractual right to be repaid their original investment under certain conditions that are previously negotiated. Triggers for mandatory repayment can include events like the company filing for bankruptcy, being delisted, acquisitions, failing to register shares, or breaching financial covenants.

- Enhanced Redemption Rights - Gives investors the option to redeem shares for cash if certain events occur, like missing financial targets, undergoing a major strategic change, or if a liquidity event doesn't occur by a certain date. Redemption is at the investor's discretion if triggers are met.

Price Protections

Provisions that protect the share price/conversion price for PIPE investors, and typically implemented in some form of reset or floor pricing. But price protections can get very dilutive to existing shareholders, so companies try to negotiate limited protection.

- Reset (Variable) Pricing - Allows for conversion price to reset lower if the stock price falls under a certain price.

- Make Whole Provision - Require additional shares to be issued if the stock trades below a certain price at conversion.

-

Floor Pricing - A price floor sets a minimum conversion price for convertible securities. If the stock trades below this floor price after the PIPE closes, the conversion price resets to the floor instead of the lower market price.

- Hard Floor - A pricing floor that remains in force throughout the life of the investment and is not subject to conditions or adjustments (downward or upward) and does not provide investors with a remedy to be "made whole" in the event the market price of issuer's common stock falls below the hard floor price.

- Soft Floor - A pricing floor that may be subject to certain conditions, time limitations, or adjustments and/or provides alternative means for the investors to be "made whole" in the event the market price of the issuer's common stock falls below the soft floor price.

"Toxic" or "Death Spiral" - Toxic or death spiral PIPE transactions involve the issuance of convertible securities with a variable conversion ratio that resets lower as the stock price declines, typically without a floor price, resulting in an downward spiral of extreme dilution as lower stock prices trigger conversions into more and more shares. These predatory PIPE deals allow investors to benefit at the expense of companies, which are often distressed and unable to secure financing elsewhere. The ever-increasing dilution often creates a death spiral for the stock price and existing shareholders.

Anti-Dilution Protections

Anti-dilution provisions protect PIPE investors from dilution of their shares if the company subsequently issues additional stock or equity linked securities at a lower price per share. These provisions allow investors to receive additional shares on conversion to maintain their proportional ownership if the share price declines due to dilution from new issuances. These protections don't refer to customary basic antidilution provisions that adjust the conversion/purchase price per share of a security in the event of a stock split, stock dividend, merger, or distribution of assets.

(According to 2 sources I found online, in 2017-2018, about 90% of PIPE deals with convertible notes or preferred stock included anti-dilution provisions) 1, 2.

-

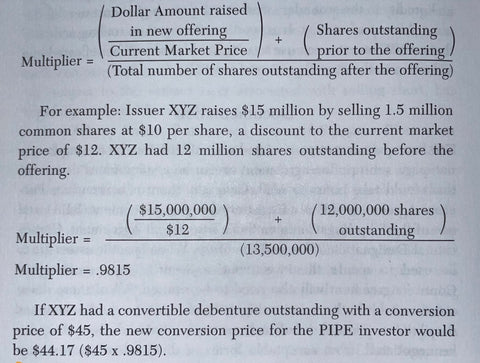

Weighted Average - Uses a formula to adjust the conversion price downward if the company issues new shares at a lower price, protecting PIPE investors from dilution but to a lesser degree than full ratchet provisions. The formula creates a multiplier which is then applied to the existing conversion or purchase price.

- Full Ratchet - Full-ratchet antidilution protection takes antidilution to a different level for the PIPE investor. With full-ratchet protections, the conversion or purchase price is reduced to the exact price of the subsequent offering. In the above image example, the investor would have his conversion price adjusted from $45 to $10. Wheras some full-ratchet protection is subject to a floor price, this type of adjustment greatly protects the investor from being diluted at lower prices.

Advantages & Disadvantages of PIPE Deals

Advantages and Disadvantages for the ISSUER

Advantages:

- Quick access to capital - PIPE deals can close faster than public offerings since there is no upfront SEC registration process.

- Confidentiality - PIPE deals are negotiated privately before public announcement, allowing issuers to keep deals confidential during negotiation.

- Flexible structure - Issuers can negotiate customized deal terms like pricing, dilution protection, registration rights etc. to meet their needs.

- Less market impact - A PIPE has less negative impact on the stock price than a public offering announcement.

- Shareholder expansion - These deals can expand the institutional shareholder base through targeted marketing.

Disadvantages:

- Dilution - Issuing shares at a discount to investors means more shares outstanding, resulting in dilution costs for existing shareholders.

- Less proceeds - PIPE deals typically raise less capital than public offerings due to size limitations. Most are for less than $100 million.

- Investor demands - PIPE investors may require stronger deal terms, principal protections, or control rights compared to public investors.

- Registration burden - The issuer bears the cost of registering the PIPE shares for resale after closing. This includes legal, accounting and filing fees.

Advantages and Disadvantages for INVESTORS

Advantages:

- Negotiation power - PIPE deals allow investors to gain exposure to companies through private placements before they go public. Investors can negotiate customized terms like pricing, registration rights, anti-dilution protections, etc. to meet their investment objectives.

- Pricing discounts - PIPE deals are often done at a discount to the market price, allowing for significant returns if the share price increases post-investment.

- Confidentiality - PIPE negotiations remain confidential until publicly announced, avoiding potential leaks that could impact public markets.

- Avoid market dump - Direct placements typically avoid share sell-off that occurs when a company announces it's issuing more shares to raise capital.

Disadvantages:

- Illiquidity - Investors cannot sell their shares until after resale registration, locking up their capital for months. Lack of liquidity is a major drawback.

- Extra due diligence - Less information may be available on private companies doing PIPE deals compared to public companies so doing due diligence is very important.

FAQ's

What is the difference between a registration statement and a prospectus?

The registration statement contains full detailed disclosures submitted to the SEC prior to an offering, while the prospectus is the the legal document within the registration statement distributed to potential investors describing the offering, securities, company, risks, and financials. The prospectus is part of the registration statement.

Why do more complicated securities tend to be issued through Private Placement offerings?

The most likely purchasers of sophisticated securities are sophisticated investors. Sophisticated (accredited) investors are better suited to protect themselves and have the experience to do thorough due diligence before purchasing securities.

Can a pipe deal use an existing s-3 shelf for resale of shares?

Usually, the existing shelf registration statement is a primary shelf registration statement covering the sale by the issuer of newly issued securities. For a traditional PIPE, the issuer is required to file, and have declared effective, a resale registration statement covering the resale by the PIPE purchasers (a selling stockholder shelf registration) the securities purchased in the transaction. Unless the issuer's existing shelf registration statement covers sales by selling stockholders, the issuer will be required to file a resale registration statement to effect a traditional PIPE.

|

The book PIPEs: Private Investments In Public Equity is a great resource that I highly recommend for anyone that wants to learn more PIPEs. The authors do a great job breaking down the details of how PIPE transactions work and the strategic considerations for various parties involved. Some sections get a bit technical, but the writing is clear and pretty easy to follow along. |

More Sources

https://centerpointsecurities.com/trading-insights/

https://dilutiontracker.com/app/learn

Check out my next book summary and review: Sold Short: Uncovering Deceptions in the Market

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.